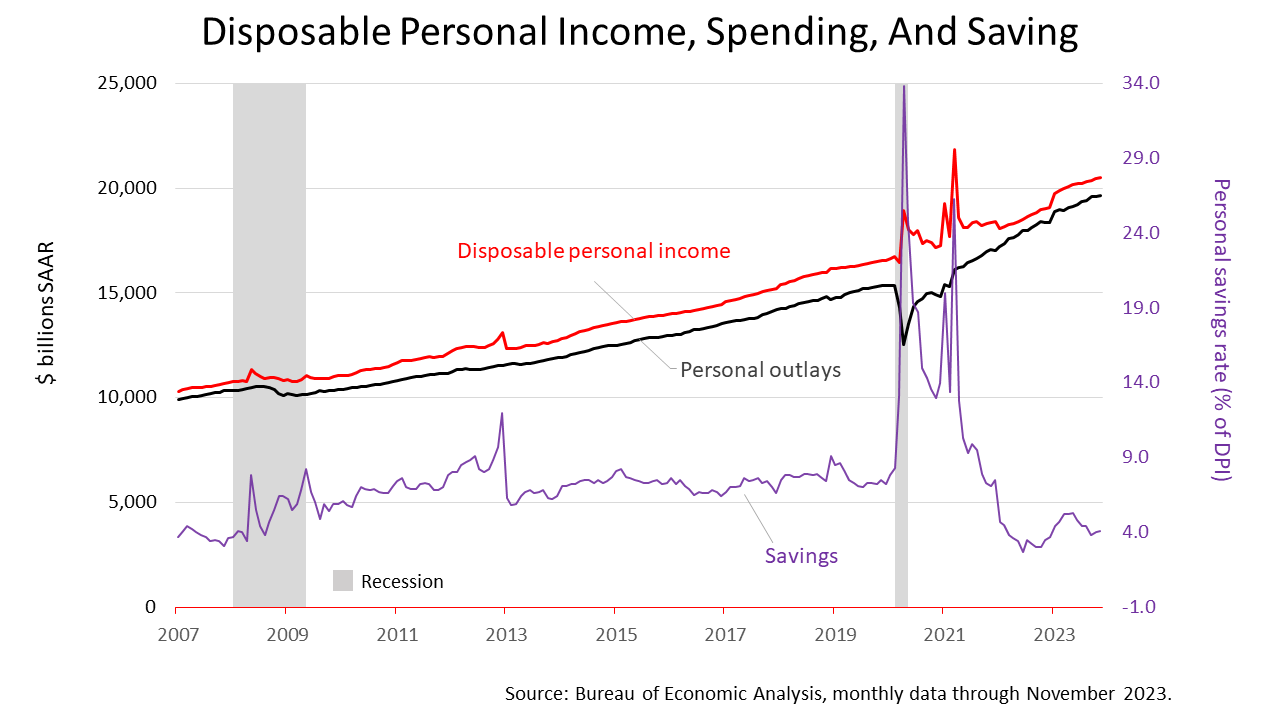

Disposable personal income — personal income after taxes — rose 7.8% in the 12 months through November, consumer spending rose 7.1% and inflation continued to decline. Consumers may be starting to believe inflation is under control and the economy is improving.

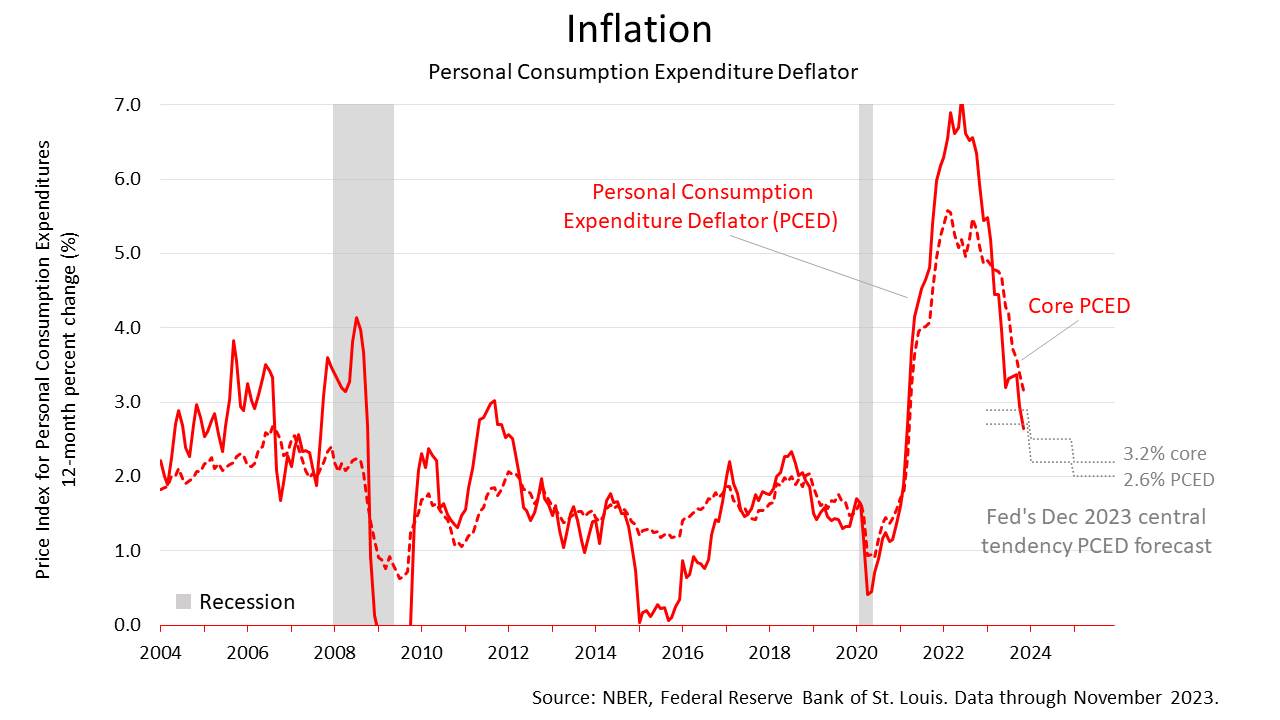

The inflation benchmark the Federal Reserve references in policy pronouncements, the Personal Consumption Expenditure Deflator (PCED), decreased by one-tenth of 1% in November. This reflected lower prices for gasoline. The PCED price index, compared to 12-months earlier, rose by 2.6%. That’s coming closer to the 2% inflation target set by the Federal Reserve.

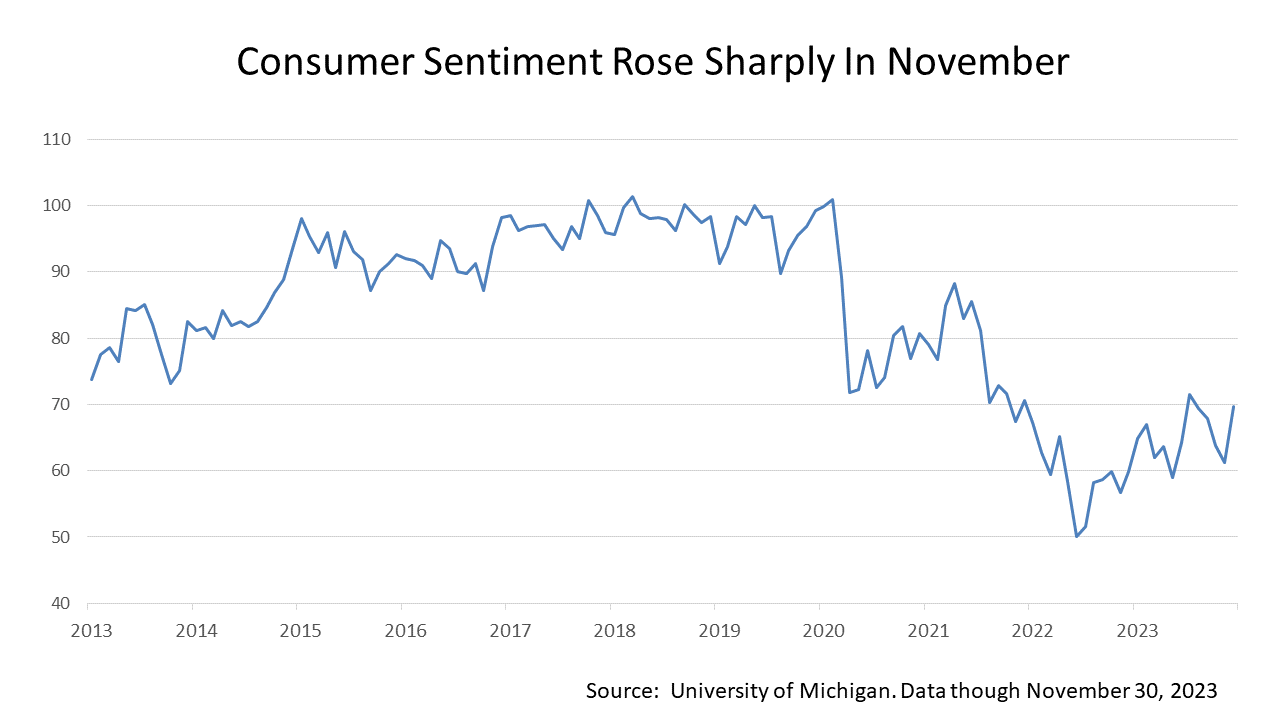

Consumers have remained glum about the outlook of the economy, despite a steady stream of statistics throughout 2023 indicating the economy was growing better than expected and that inflation was coming under control. However, that may be starting to change. The consumer sentiment index in November rose 14%, reversing all declines from the previous four months. All five components of the sentiment index rose, according to the University of Michigan, which has only occurred in 10% of monthly readings since 1978. “Expected business conditions surged over 25% for both the short and long run,” according to a UM release. “All age, income, education, geographic, and political identification groups saw gains in sentiment this month.”

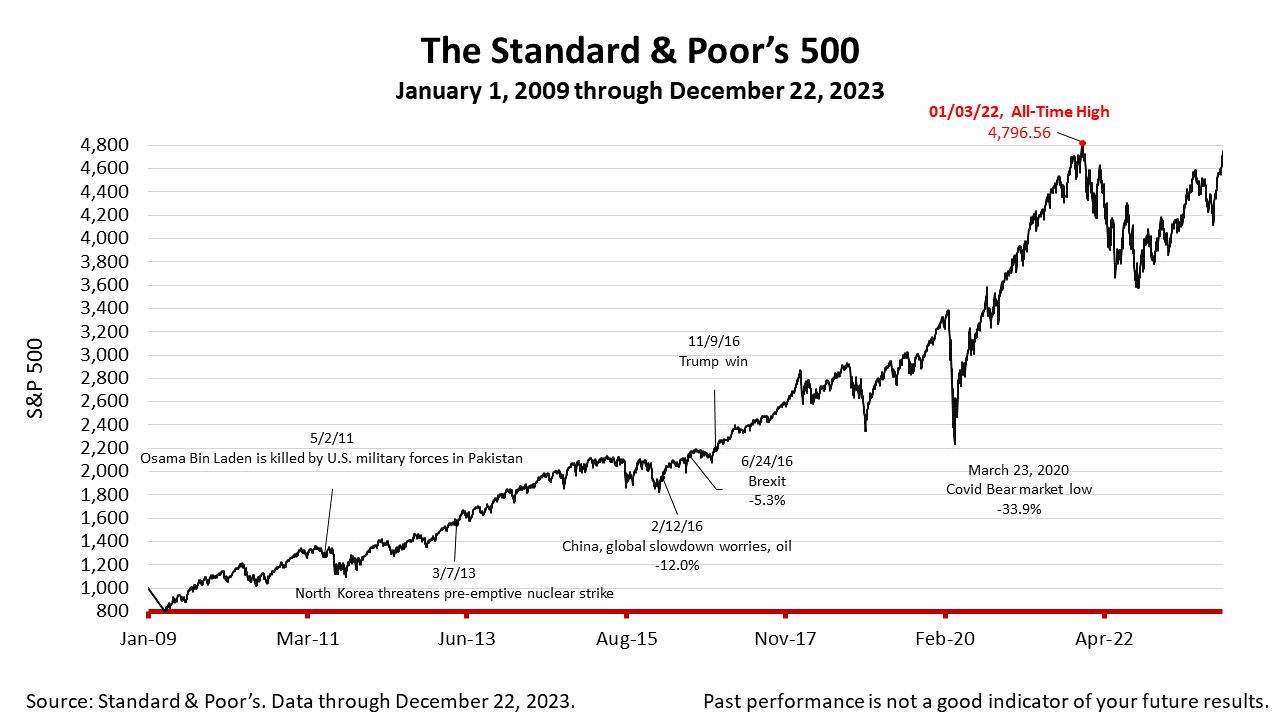

The Standard & Poor’s 500 stock index closed Friday at 4754.63, up +0.17% from Thursday and + 0.75% from a week ago, extending its winning streak for an eighth week. The index is up +112.51% from the March 23, 2020 bear market low and only -0.87% from its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.​​​​

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |