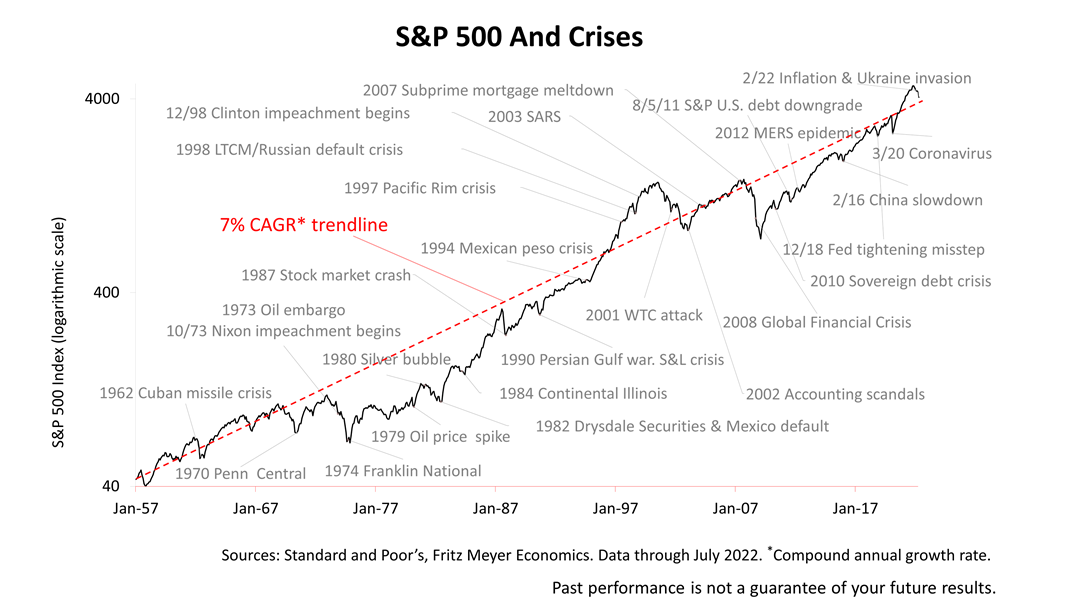

Securities regulators require financial advisors to state in their public statements that past performance is not indicative of future results because investing is complicated, and nothing is guaranteed. Ironically, however, a mountain of evidence exists showing that achieving investment success depends largely on understanding lessons from the past. Since the post-war era began in 1957, at least 27 financial crises have come and gone. Perhaps the worst crisis of the past 65 years was the near-collapse of the world financial system in 2008. It was resolved by unprecedented government intervention. Poignantly, every unprecedented crisis was resolved, often by unprecedented U.S. Government solutions and other unimagined events. Despite all of the tumult in the world, the Standard & Poor’s 500 compounded annually at a growth rate of about 7% in the 65 years ended July 31, 2022. The current financial “crisis” and bear market is the product of an unprecedented confluence of anomalies, including: - Covid 19

- trillions of government financial payments to keep consumers afloat

- supply chain disruption

- inflation

- oil sanctions on Russia

- Federal Reserve tightening hard

History is obviously not a guarantee, but it does indicate a long-term investment plan, built to last beyond crises and economic setbacks, has paid off handsomely. At the same time, please note that the current downturn and combination anomalies may not be done. The S&P 500 has rebounded sharply but the bear market may return with a vengeance if the Fed raises rates by three-quarters of 1% on September 21. Watch for statements from the Fed about moderating its plan to raise rates until then.

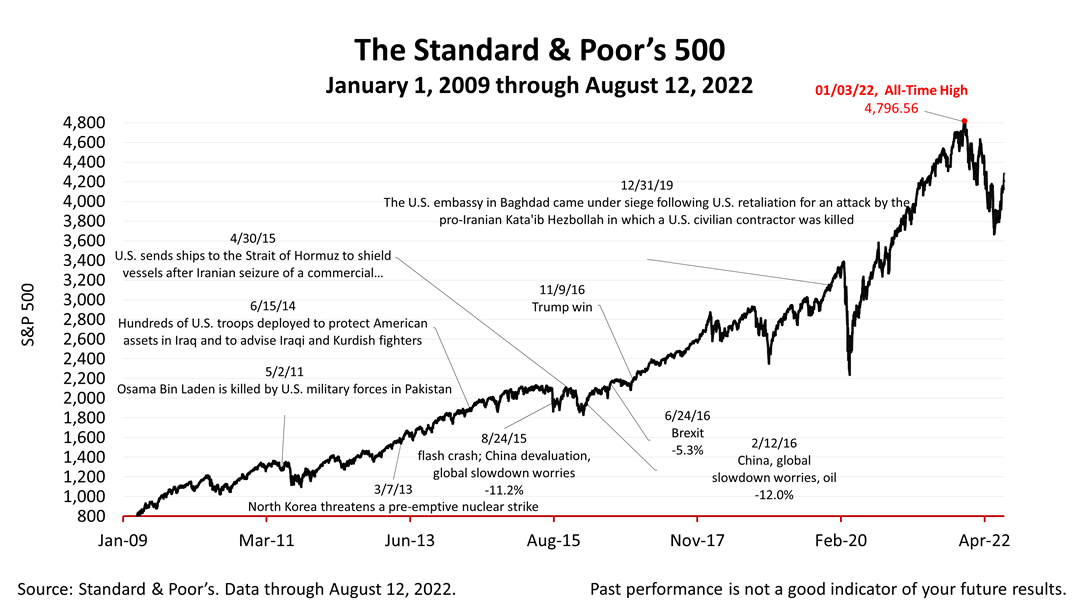

The Standard & Poor’s 500 stock index closed Friday at 4,280.15, a gain of +1.73% from Thursday and +3.2% since last week. It was the fourth consecutive week of gains. The index is up +62.68% from the March 23, 2020, bear market low and down -11.37% from the January 3rd all-time high. ​The S&P 500 is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. ​​​​​​​​ Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |