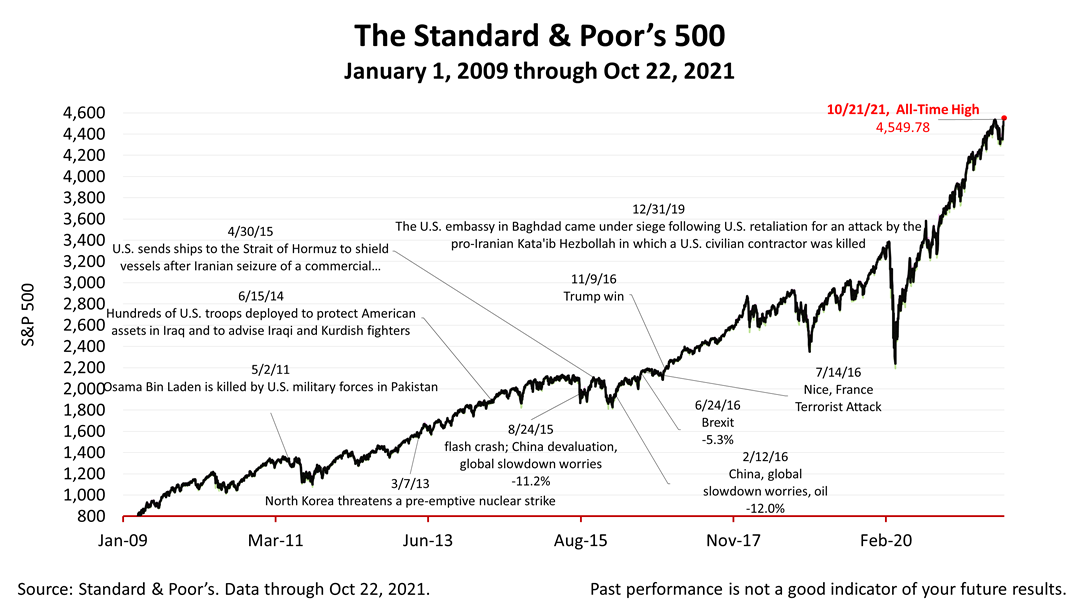

Despite the Delta variant, inflation fears, supply chain disruptions, and uncertainty in Washington on spending and tax policies, the economic recovery from the pandemic meltdown remains intact. After losing about 5% in September, the Standard & Poor’s 500 stock index has rebounded in the last three weeks and closed at a new record high on Thursday.

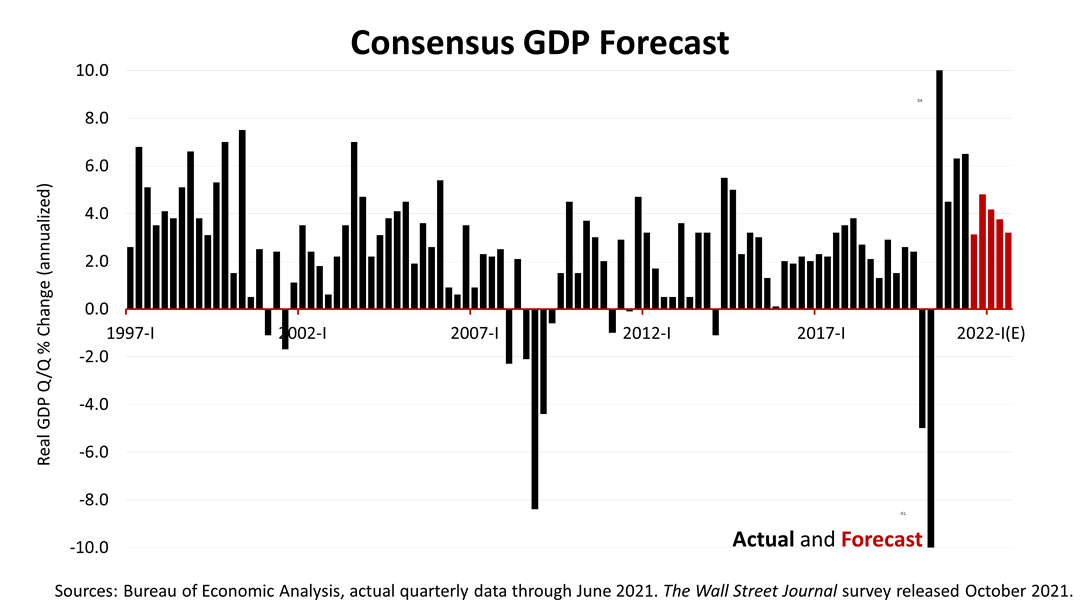

The 60 economists surveyed in early-October by The Wall Street Journal expect the expansion to extend over the five quarters ahead. The consensus forecast is that the growth rate for the third quarter of 2021 will land at 3.1%, followed by 4.8% growth in the current quarter, with 4..2%, 3.8%, and 3.2% growth rates expected in the first three quarters of 2022.

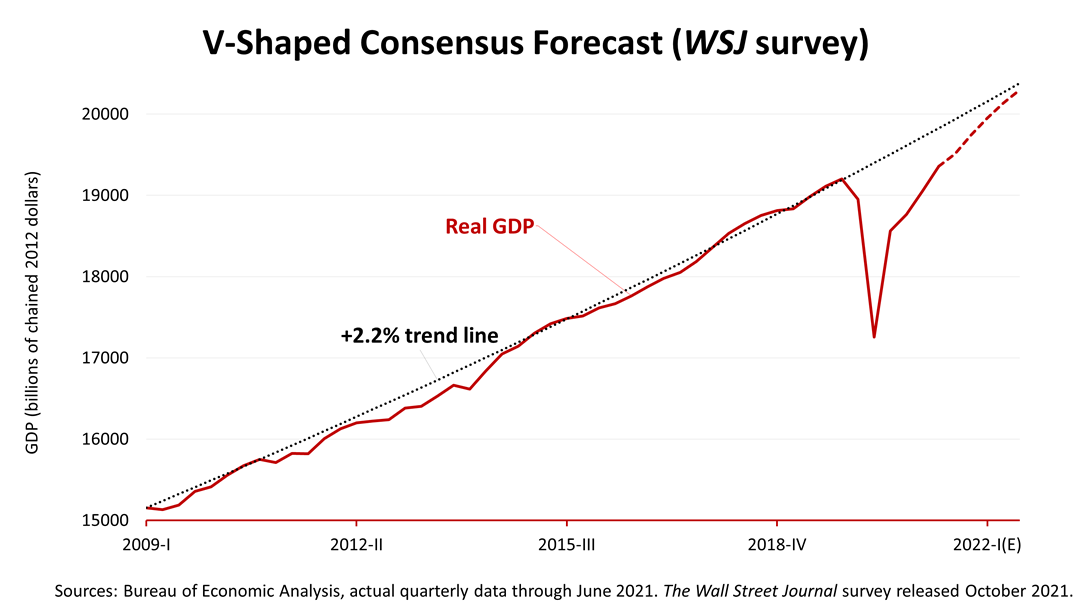

Based on the consensus forecast of economists surveyed by The Journal shown in the dotted red line, the economy is expected to be back on its long-term growth trajectory, shown in the gray line, a year from now -- as if the pandemic never happened.

The Standard & Poor’s 500 stock index closed Friday at 4,544.90, one-tenth of 1% lower that the all-time closing high it had hit on Thursday. The S&P 500 was up +1.63% from last week. The index is up +68.04% from the March 23, 2020, bear market low. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |