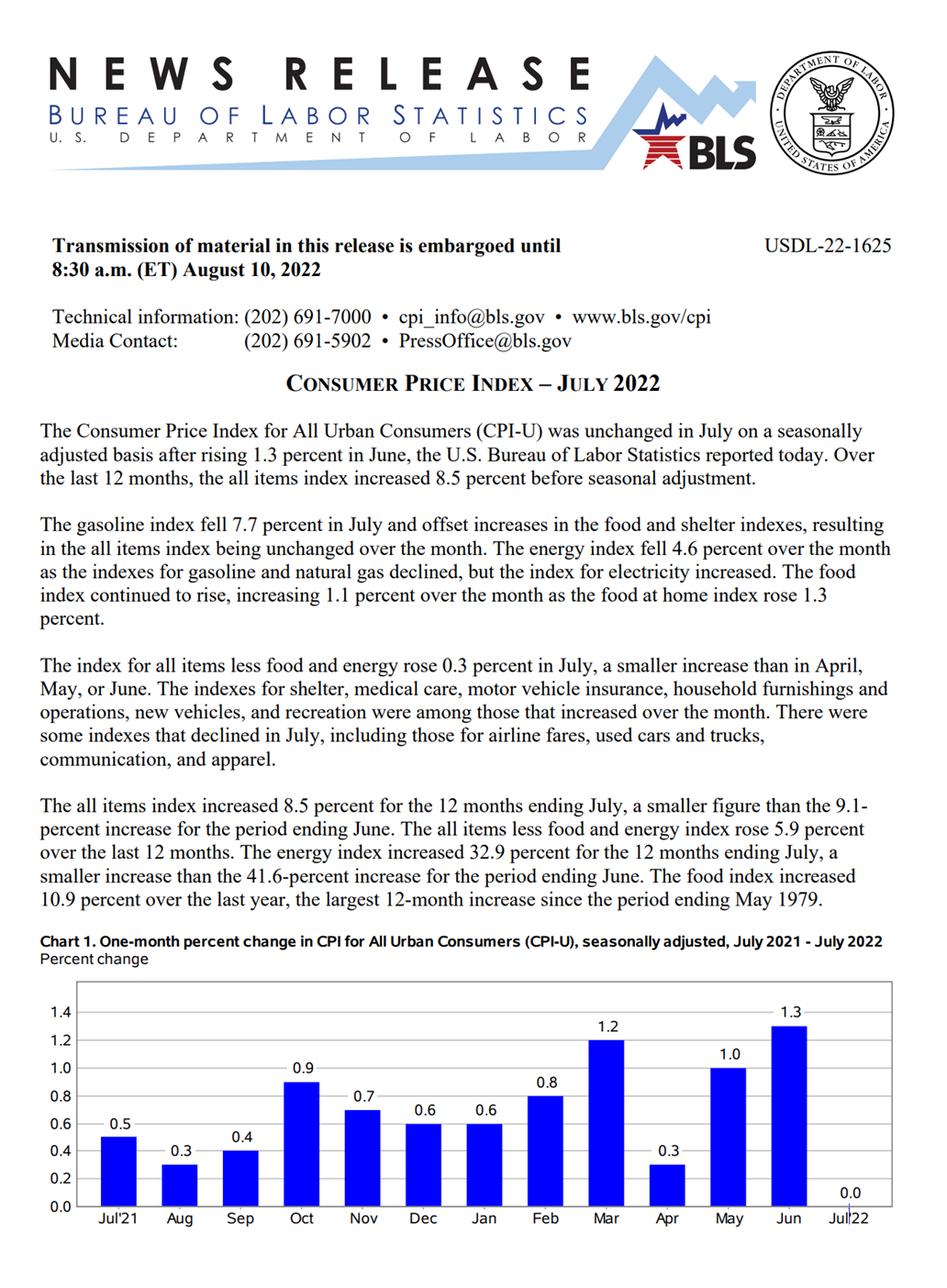

Inflation cooled in June, according to Labor Department data. Compared to the +9.1% inflation rate in the 12 months through June 30, the consumer price index (CPI) in the 12 months through July 31 increased by +8.5%. The Standard Poor’s 500 rallied +2.1%. Inflation cooled in June, according to Labor Department data. Compared to the +9.1% inflation rate in the 12 months through June 30, the consumer price index (CPI) in the 12 months through July 31 increased by +8.5%. The Standard Poor’s 500 rallied +2.1%.

However, just because inflation cooled in July and may even have peaked does not mean the worst of the financial economic turbulence is behind us. For long-term retirement investors and individuals building family wealth for the next generation, it’s prudent to expect current conditions to worsen. Long- term investors must always deploy assets fully mindful that the timing of the next stock market decline or surge is virtually impossible to predict. However, predicting that the U.S. will grow after the current turbulence subsides is easier and that fundamental economic driver should serve as the linchpin in a strategy to build wealth. A bear market began on June 13, when the Standard Poor’s 500 stock index closed more than -20% lower than its all-time closing high on January 3. By the close on June 16, the S&P 500 stock price bottomed out with a loss of about -23%. That’s a much smaller loss than typical bear markets in the recent past of 30, 40, or -50%. In addition, if the Federal Reserve raises lending rates by 75 basis points on September 28, as is widely expected, then the yield curve will be inverted, which means that 90-day Treasury Bills would yield more than 10-year Treasury Bonds. Inverted yield curves in modern history have usually been followed within months by a recession and bear market. Remember, investing is only one aspect of planning for retirement and building intergenerational wealth. Are you integrating strategic tax and financial planning with your investments? Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |