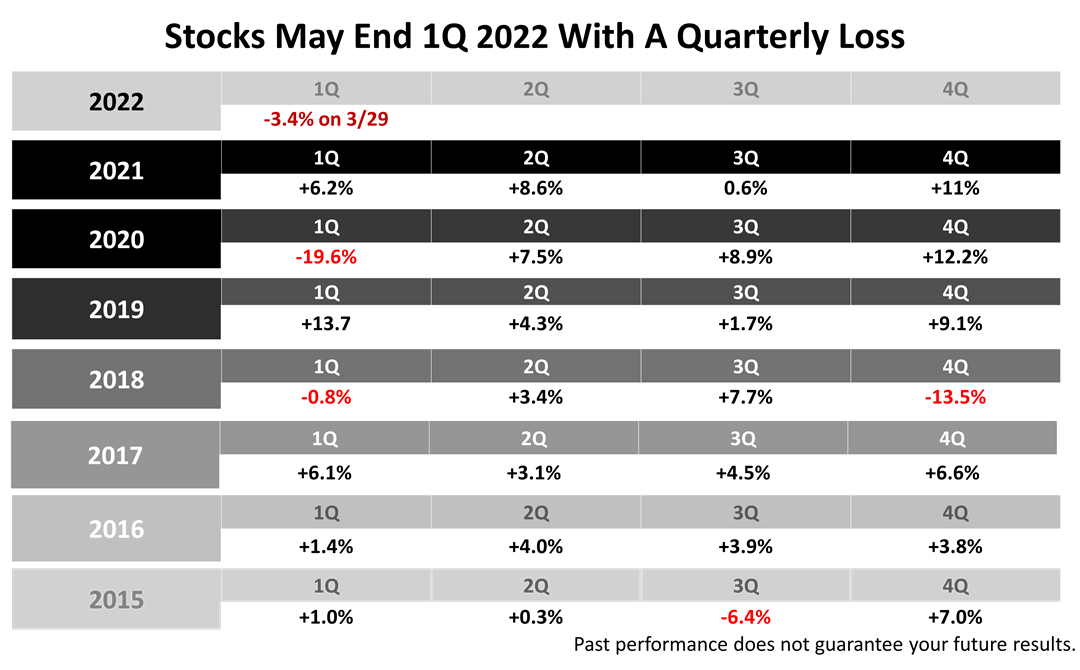

As the first three months of 2022 come to an end, the stock market is on the way to its first quarterly loss since the first quarter of 2020, when the Standard & Poor’s 500 index lost -19.6% of its value. To be clear, stocks returned profits in seven straight quarters following the first quarter of 2020, when the pandemic struck.

This table shows how often a losing quarter has occurred since 2015. Past performance never is a guarantee of future results, and there is a risk the pattern of intermittent losses shown here will not be repeated. That risk is precisely why the stock market has rewarded investors with much greater returns than risk-free government backed Treasury Bills for many decades! The stock market is volatile and may yet end the quarter on Thursday by eking out a gain. If not, we want to remind you that the stock market, as measured by the S&P 500 index of America’s largest publicly investable companies, is up about +17% in the past 12 months and nearly +70% since the Covid low of March 23, 2020. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |