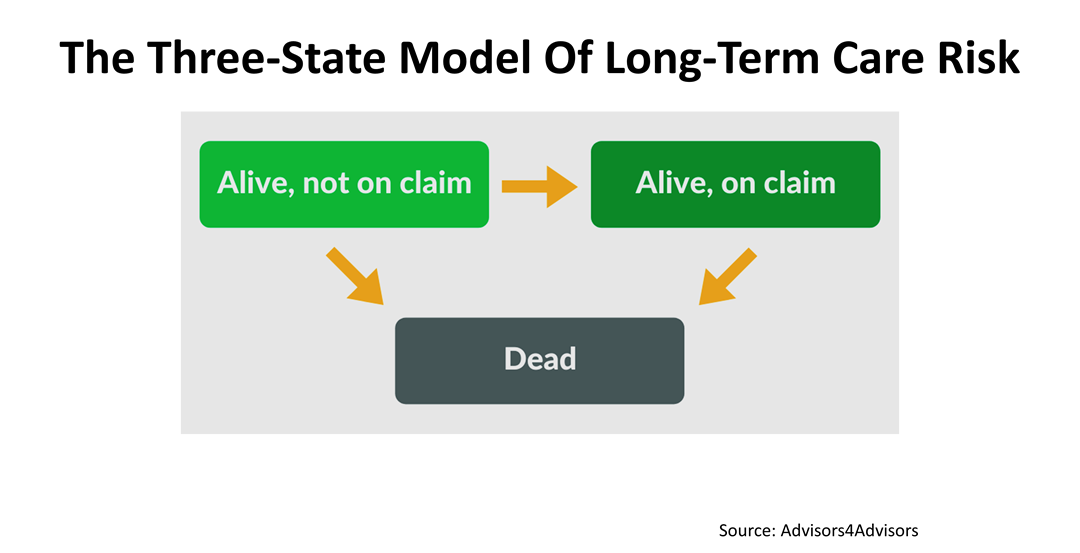

Long-term care insurance (LTCI) has been sold to consumers for less than 50 years. With little historical data to draw from in pricing policies, insurers made overly optimistic assumptions for decades. Today's LTCI policy owners often are receiving premium increase notices. They are forced to accept lower benefits or to pay more to keep their current benefits. And individuals who are buying LTCI for the first time are entering the market at a time of upheaval. Here’s guidance. It’s an understatement to say long term care is a risk that needs to be managed carefully. Individuals who purchased LTCI policies years ago are receiving premium increase notices because of the incorrect actuarial and health risk forecasts made by insurance companies. LTCI is a difficult topic in making a sustainable financial plan that will insure you against the risk of needing to stay at a long-term care facility or receive home care when approaching your final years of life. Life insurance involves one risk: mortality. In contrast, long-term care insurance involves two risks: mortality and morbidity (health), and these risks occur at the same time. Since the 18th century, when mathematicians were studying smallpox epidemics, problems involving simultaneous risks have been solved by doing multi-state modeling.

This simple three-state model illustrated here, when applied by an insurer to the monthly risk of a person dying or stricken ill, can result in more than 50,000 different outcomes over your lifetime, according to independent analysis. For example, you could die in month 240. Or you could go on claim in month 113 and die in month 300. Any number of possibilities could occur and the paths are not all equally likely. Insuring you can receive long-term care in your older years depends on your personal situation and it requires analysis from a professional. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |