Consumer sentiment is depressed, and business owner optimism declined by 18 points in the four months between August and November. Amid the Covid-weary, inflation-battered economy, here are 10 signs the economy is doing much better than most consumers and businesses think.

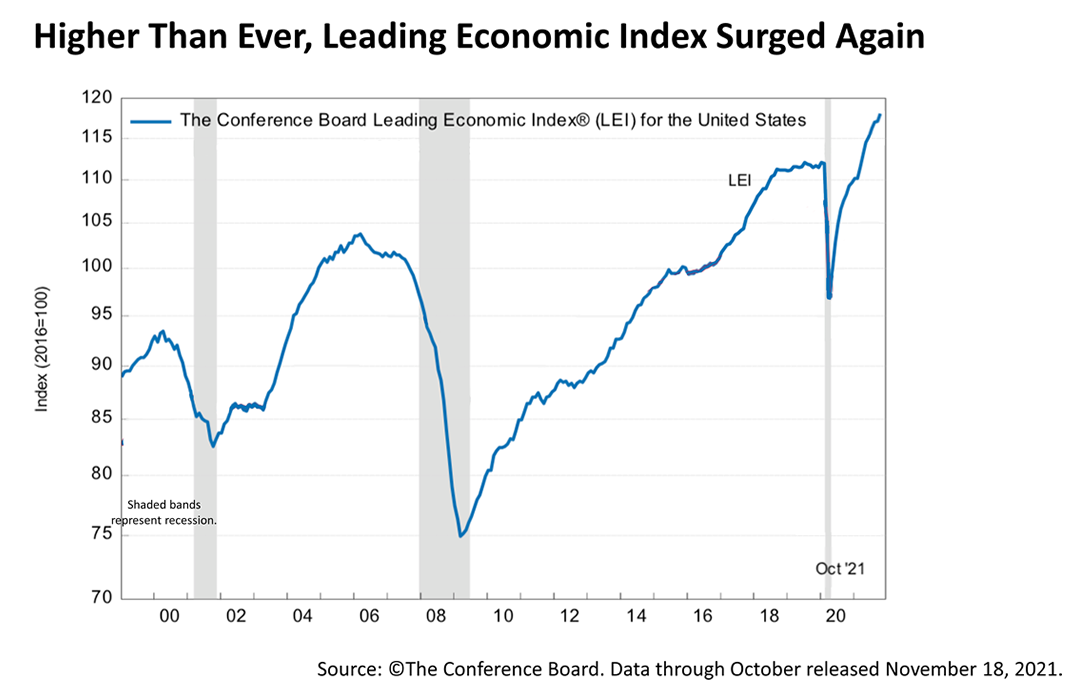

The U.S. Leading Economic Index (LEI), has soared well beyond heights previously reached in modern history in recent months, and it surged again in November. The index of leading economic indicators is at an all-time high, suggesting the current economic expansion will continue into 2022 and may even gain some momentum in December and into the first quarter of 2022.

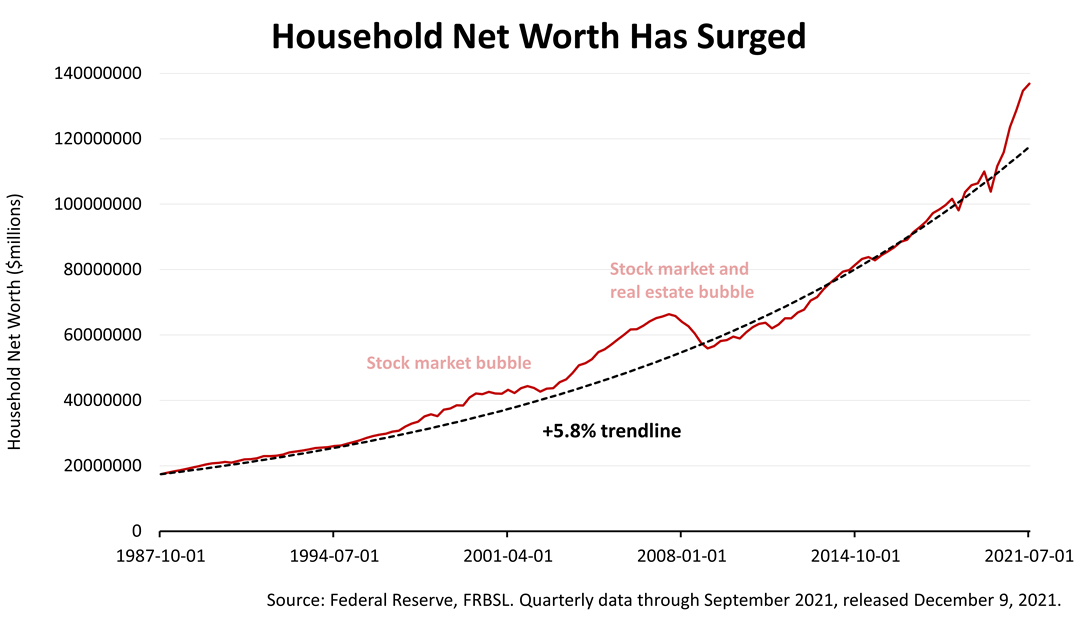

Household net worth has surged on stock market and real estate gains, according to newly released data from the Federal Reserve Bank. The dotted gray line shows the 5.8% average annual growth rate in household net worth versus the current reading, which has gone parabolic. Liquidity pumped up cash in Americans’ checking and savings accounts from pandemic aid stocks and home prices have soared. “The ‘wealth effect’ is something real,“ according to economist Fritz Meyer. “And it is doing something that it hasn't done since the last bubbles in both the stock market and real estate. When household net worth goes higher, it stimulates higher spending, which stimulates higher stock prices."

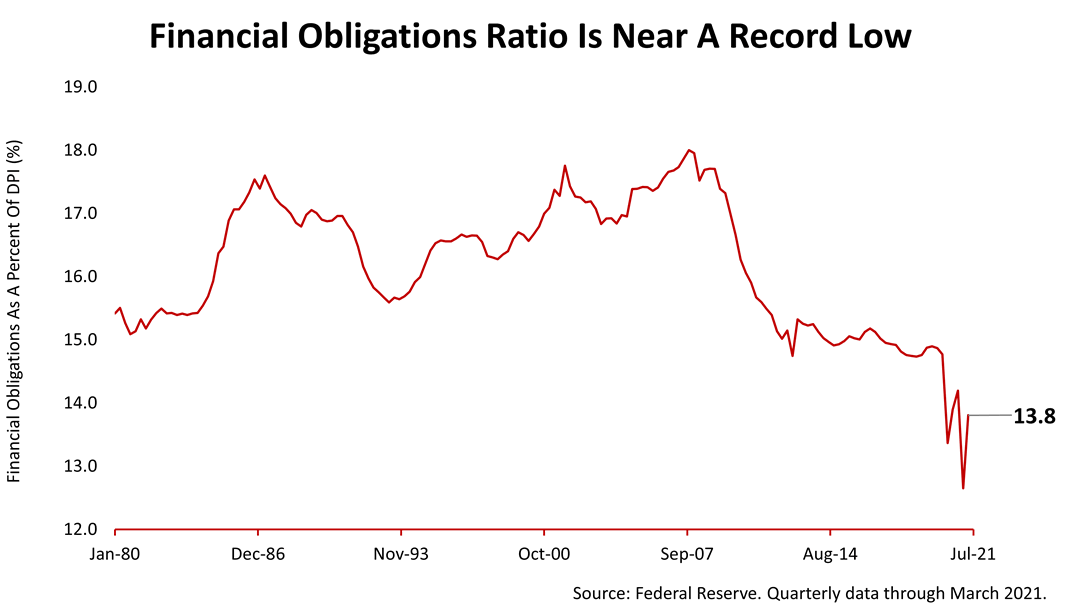

The latest financial obligations ratio from the Fed shows the percent of monthly after-tax income that the average household pays for fixed monthly obligations, such as a mortgage, car payments, utilities, and real estate taxes, is near a record low. This suggests there's more left over from monthly after-tax income available to spend on discretionary purchases.

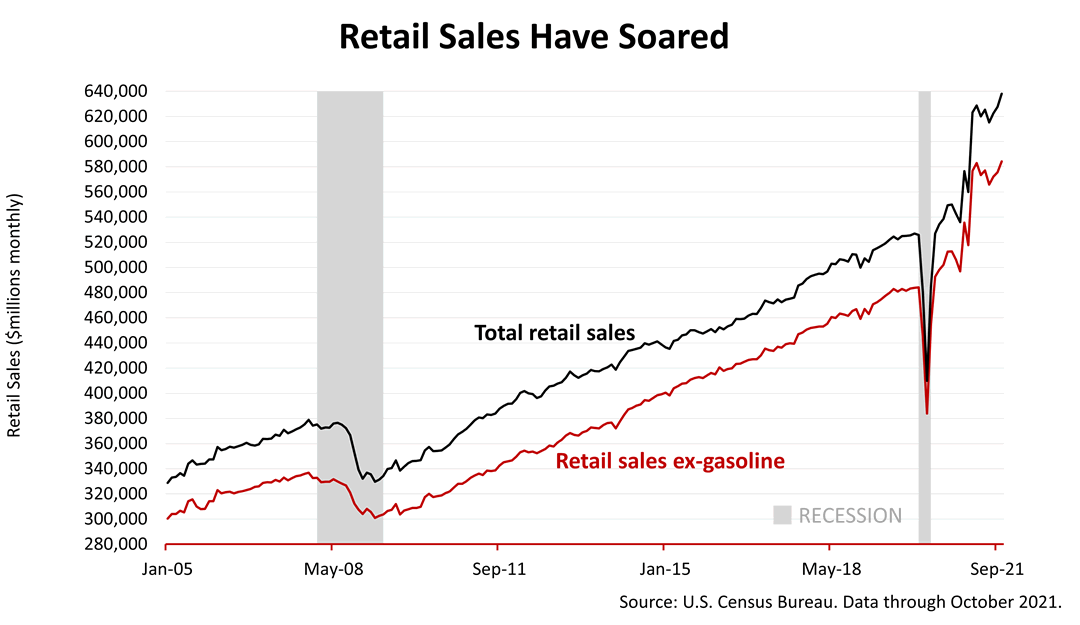

Retail sales, which account for 30% of U.S. economic activity, have skyrocketed since the pandemic first hit in March 2020. Retail sales have not returned to their pre-pandemic growth trend, they’ve soared well beyond. Retail sales consist mostly of tangible products, as opposed to services. This indicates people may be spending more on goods versus services than they do historically because of Covid-19.

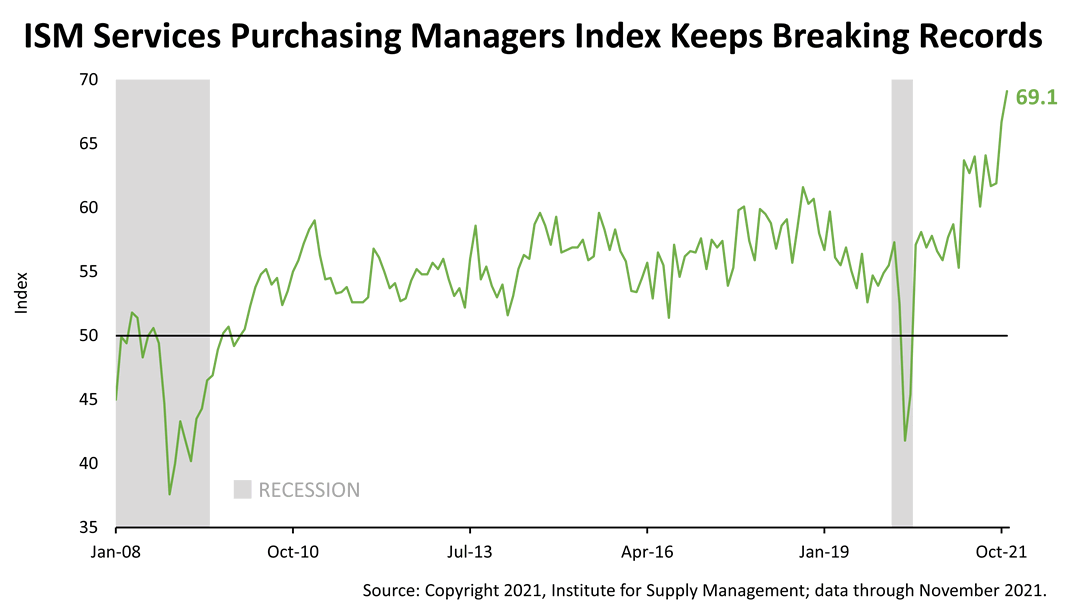

The Institute of Supply Management’s survey of business conditions monthly at service-sector companies has soared to a record high. The service sector accounts for 89% of U.S. economic activity and 91% of non-farm jobs. A forward-looking component of this index, which measures the flow of new orders, was also at a record, at 69.7.

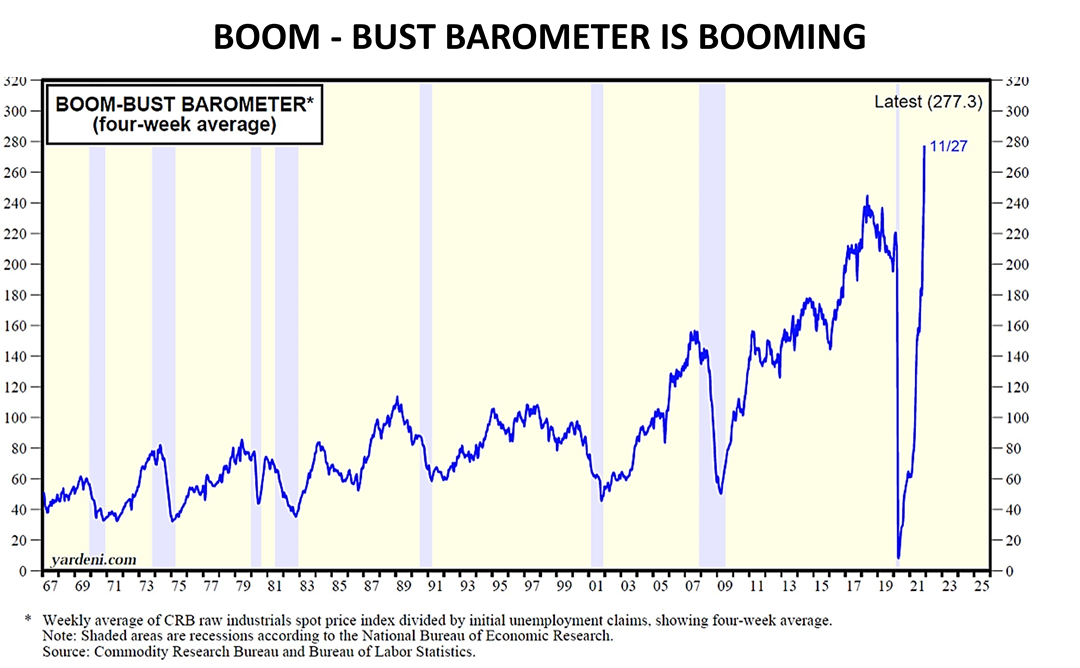

Commodity prices recently hit a record high while initial unemployment claims plunged, causing Yardeni Research’s Boom-Bust Barometer to go parabolic. Shown here since 1966, the boom-bust barometer went bust when Covid hit the U.S. in February 2020 but in March 2020 when the recovery began, it soared and in recent months it’s soared faster and higher than ever before! Dr. Yardeni designed the Boom-Bust Barometer to predict economic slowdowns before they become recessions and for predicting expansions before they become booms. The index divides the price of a basket of commodities by the number of initial unemployment claims, and it has a good track record as a reliable predictive tool. It’s current reading is consistent with expectations of a boom in the economy. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |