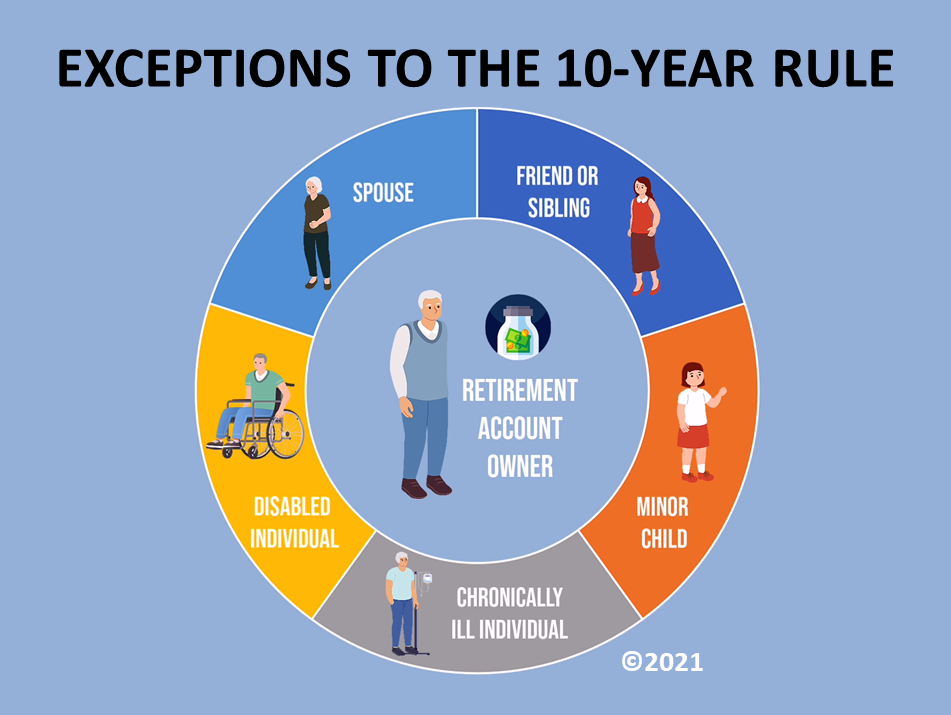

Tax law and estate planning might bore you to death, but this brief tip could make a life-changing financial difference to your surviving spouse, and other loved ones, including disabled and chronically ill family or friends, as well any minor children in your life. These individuals are among the five exceptions to the usual distribution rules on the inheritance of assets in IRA, 401(k), or other federally qualified retirement plans. New rules, that went into effect on January 1st, 2020 with the enactment of The Secure Act, require the beneficiary of inherited IRA or 401(k) accounts to deplete the money in those accounts within 10 years. It was a technical change that many overlooked in the rush of tax law changes that occurred in 2020 during the pandemic. But it made a big difference in tax planning. To be clear, until 2020, beneficiaries of an inherited IRA or 401(k) were not required to liquidate an inherited account within 10 years, as is now required, which had left open a major tax break: They had the option to stretch out distributions over their actuarial life expectancy, thus, leaving the assets to compound tax-free for a much longer period. The 10-year mandatory distribution rules carved out some key exceptions for certain individuals that now require attention, if you intend to pass on your retirement plan, IRA or other qualified plan assets to a spouse, chronically ill or disabled individual or minor child. For a disabled individual, who inherits federally qualified retirement assets, for instance, stretching out distributions over decades could transform the inheritance into an income stream for life. The same is true for a widower, chronically ill individual, or minor child that inherits your retirement account. In addition, a fifth exception to the usual distribution rules applies to a beneficiary that is less than 11 years younger than the retirement account owner. A sibling or friend who is 10 years or less your junior, who inherits qualified retirement account assets, also may use their life expectancy -- instead of taking required distributions over 10 years. If you own a sizable IRA, 401(k) or other qualified account, and your beneficiary is your spouse, a friend or sibling 10 years or less younger, an individual with a disability, chronic illness, or a minor child, the five exceptions to the 10-year rule pose complicated tax planning as well as legal and investment issues requiring personal advice from a professional that is beyond the scope of this article. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |