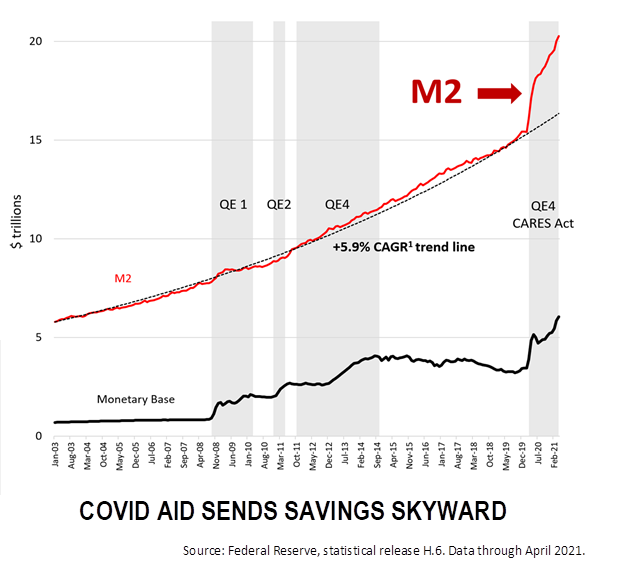

For the past decade, monetary easing measures implemented by the U.S. Federal Reserve expanded the monetary base but not the money supply. The surge in money supply, aka M2, is a major financial change currently unfolding now. M2, currency held by the public, plus checking, savings and money market accounts, skyrocketed like never before following the $5.5 trillion unprecedented US stimulus and aid payments in response to the pandemic. After the global financial crisis of 2008, Fed easing was implemented principally through its purchases of US long-term bonds. That added liquidity to the monetary base, but it did not boost M2. Fed easing is different this time. Direct payments from Uncle Sam have loaded Americans with an unprecedented cash reserve that’s just been waiting to be spent. The stock market is at record highs and could keep rising, but inflation risk could cause a sharp decline. Tax hikes are simmering, leaving this last bit of time to act if your adjusted gross income is more than $400,000 or if you, your parents, or grandparents own assets worth more than $3.5 million. That’s what’s happening now in wealth management. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |