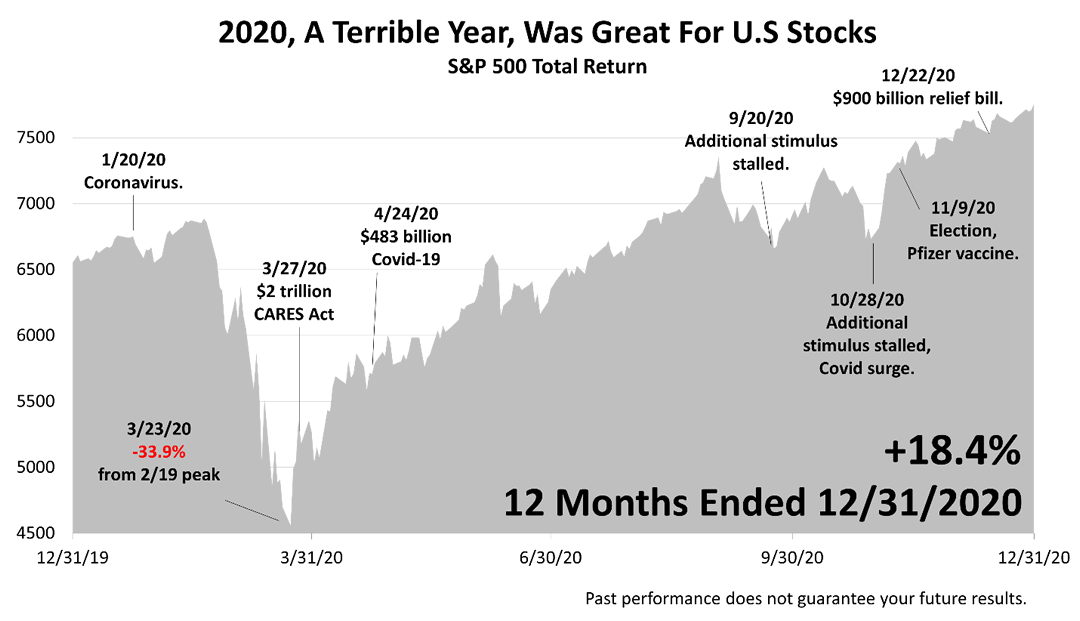

2020 was the cruelest year. The pandemic afflicted friends and families; it got personal. If you’re lucky, Covid merely upended your family, forcing grown children to move back home. Maybe you gave up a spare bedroom or lost your den. For many American families, however, 2020 brought the cruelest loss: sickness and death. For many investors, 2020 also taught a cruel lesson. Last March, many investors sold stocks when the S&P 500 plunged an initial -10%. Some sold when the market nosedived by -20%. Ultimately, the bottom of the 2020 Covid bear market came on March 23rd with a loss of -33.9%. At that bleak moment, only a professional who has studied the history of economics and investments would have felt confident advising you what to do. Only a professional who has been trained to know how bad the world may look at the worst of times, is likely to remind you that people are resilient and progress has always been unrelenting. Living through financial crises adds crucial perspective, as does continuing professional education. Sometimes, being an advisor is not about telling people what to do but helping people to decide what NOT to do. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results. |